Jakarta – Physical and transition risks may cause disruption to monetary and financial stability, a Bank Indonesia official said Friday (18/2) in a G20 Finance Track side event in Jakarta titled: “Building A Resilient Sustainable Finance”. Bank Indonesia Executive Director of Macroprudential Policy Department Yati Kurniati, said that the risks among other things could impact price volatility and inflation.

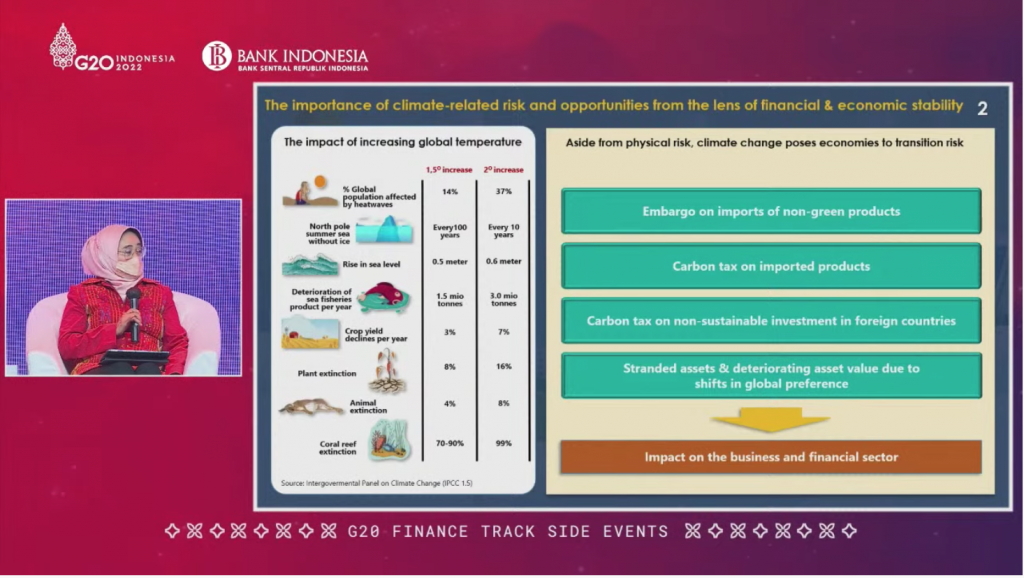

“Physical risk (that emerges from) global climate change serves as an important reminder to the global society of the urgency to act together to mitigate the cost of climate change,” she said, adding that increase in risk premium on interest rate for non-green sectors and external discrepancies that may affect capital outflows and exchange rates to limited export and external financing sources because of the non fulfilment of green requirements.

Kurniati cited that global insured loss reaches USD 140 trillion and uninsured loss covers USD 200 trillion. “That is so enormous. Natural disasters that emanated from global climate change have resulted from severe drought and also severe floods that resulted in huge catastrophes,” she said.

“Climate change also poses economic risk through transition risk. Climate change impacts and shifts energy sources, affecting how the financial sector assesses risk and return. The shifting process itself triggers transition risks as stranded assets could perceive cause of changing in investors preferences,” she said.

The fastest way to cut emissions and reach net zero is through transforming energy. Increasing efficiency and substituting electricity generation with renewable resources are among the sure ways to reach a net zero.

“First we have to better understand what is the climate-related risk and how the implications of those risks are to the financial and economic stability. This will lead us to emphasise the importance of managing such climate risks,” said Kurniati.

She said that policy makers and all the economic agents should work hand in hand in adapting to withstand and support resilient and sustainable models for the benefit of our future.

“Finance will complement and potentially amplify but never substitute for climate policy actions. Officials across all nations must require and have standard disclosure reporting,” said Kurniati.

“Major global banks, insurance companies, investment managers, writing agencies and even accounting firms all have roles to play to support the acknowledgement of environmental-related hazards. Financial authorities also need to set an supervisory rule for financial best practices in the risk management and support sustainable finance and investment while cooperation must adapt their business operations to transition themselves to carbon neutral.”

Low carbon transition requires huge investments

The transition to low-carbon energy from fossil energy requires not only commitment but also large funding. The International Energy Agency estimates that the low-carbon transition in energy sector investment each year requires funding of around USD 3.5 trillion or around IDR 50,050 trillion.

Based on a study from the Swiss Institute, the earth’s temperature will increase by 3.2 degrees Celsius and eliminate potential global GDP by 80 percent if no steps are taken. However, if the Paris Agreement targets are achieved by each country, the maximum temperature increase can be reduced from 3.2 degrees Celsius to 2 degrees Celsius. In addition, GDP shrinkage is limited to 4 percent.

Huge efforts must be taken and massive reallocation of capital needed to control climate change, as well as reduce the risk of natural disasters. This amount is even greater than the cost of handling climate change, the cost of handling the 2008 global crisis and the Covid-19 pandemic.

In Indonesia, currently holding the G20 presidency, the implementation of the sustainable finance roadmap will focus on three main topics that are considered critical. First, develop a framework for financial transition and increase the credibility and commitment of financial institutions. Second, increasing sustainable financial instruments with a focus on accessibility and affordability. Then third, make policies that are able to encourage financing and investment that support the transition. (Hartatik/nsh)