Jakarta – The government plans to fund the transition to new and renewable energy (NRE) including through carbon tax, officials said Friday (8/4). The Ministry of Energy and Mineral Resources (ESDM) said that the need for new and renewable energy (NRE) power generation capacity in 2060 is targeted to reach 587 Giga Watt (GW).

“To achieve this target, we need a very large investment, around USD 1,042 billion until 2060,” said the Director General of New Renewable Energy and Energy Conservation of the Ministry of Energy and Mineral Resources of the Ministry of Energy and Mineral Resources, Dadan Kusdiana, in the IDE Katadata 2022 webinar, with the theme ‘Carbon Tax at The G20: Building Momentum to Accelerate a Green Recovery’, adding that all coal-power plants (PLTU) operations will end in 2056.

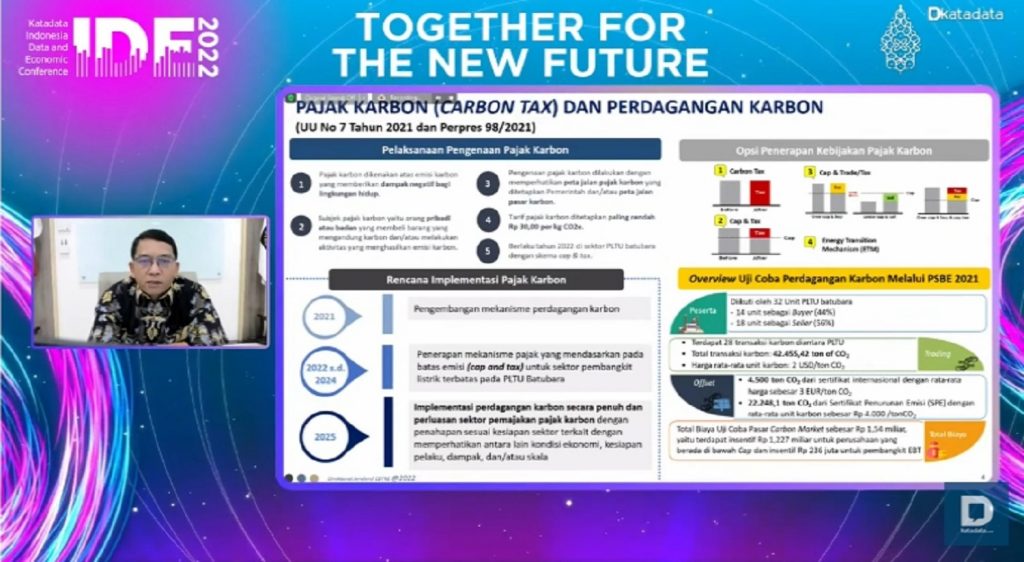

He said, global support is needed to support the reduction of carbon emissions in Indonesia. To achieve this target, the government has issued Law No. 7/2021 on Tax Regulations Harmonization that regulates carbon tax. Coal power plants will be subject to this law starting July 1, 2022 with a cap tax mechanism. A company will be subject to a limit on their greenhouse gas emissions or cap.

“A carbon tax will be imposed on coal power plants that exceed the emission threshold set,” Kusdiana explained, adding that revenue from the tax will be useful in investing in environmentally friendly technologies or providing support to low-income communities in the form of social programs.

“This carbon tax policy is a comprehensive policy package for emission reductions and as a stimulus for the transition to a green or sustainable economy,” he explained.

Meanwhile, Senior Associate, Lead Energy Taxation, International Institute for Sustainable Development (IISD), Tara Laan said, the implementation of the carbon tax will encourage companies to switch to cleaner energy technologies. For finance companies, the imposition of a carbon tax on fossil energy use will make lending in this sector riskier and less profitable in the future.

She said, “as a new source of revenue for the government, carbon taxes can be used to finance various energy transition policies. One of them is to keep energy prices affordable.”

Laan said, there are various schemes for distributing ‘subsidies’ to keep energy prices affordable, especially for vulnerable or poor economic groups, for example through cash transfers or income tax reductions. The income from the carbon tax can also be used to invest in clean energy infrastructure.

Malin Ahlberg, Deputy Head, European Climate and Energy Policy, explained that the carbon tax program has been implemented in Germany. The European country has implemented a carbon tax scheme for transportation and heating sector emissions in buildings or households which took effect in 2021. Both sectors account for more than 80 percent of Germany’s greenhouse gas emissions. (Hartatik)